Home Loan Brokers Devoted to Making Homeownership Feasible

The function of mortgage brokers in assisting in homeownership is commonly downplayed, yet their knowledge can be essential for prospective purchasers. By evaluating individual financial situations and navigating the varied landscape of home mortgage alternatives, these specialists make certain that customers are not only notified however likewise supported throughout the procedure. This customized guidance can considerably relieve the complexities linked with safeguarding a mortgage. However, the inquiry stays: how can one efficiently select a broker who straightens with their certain demands and aspirations in today's competitive market? The solution might reveal more than simply a pathway to homeownership.

Function of Home Mortgage Brokers

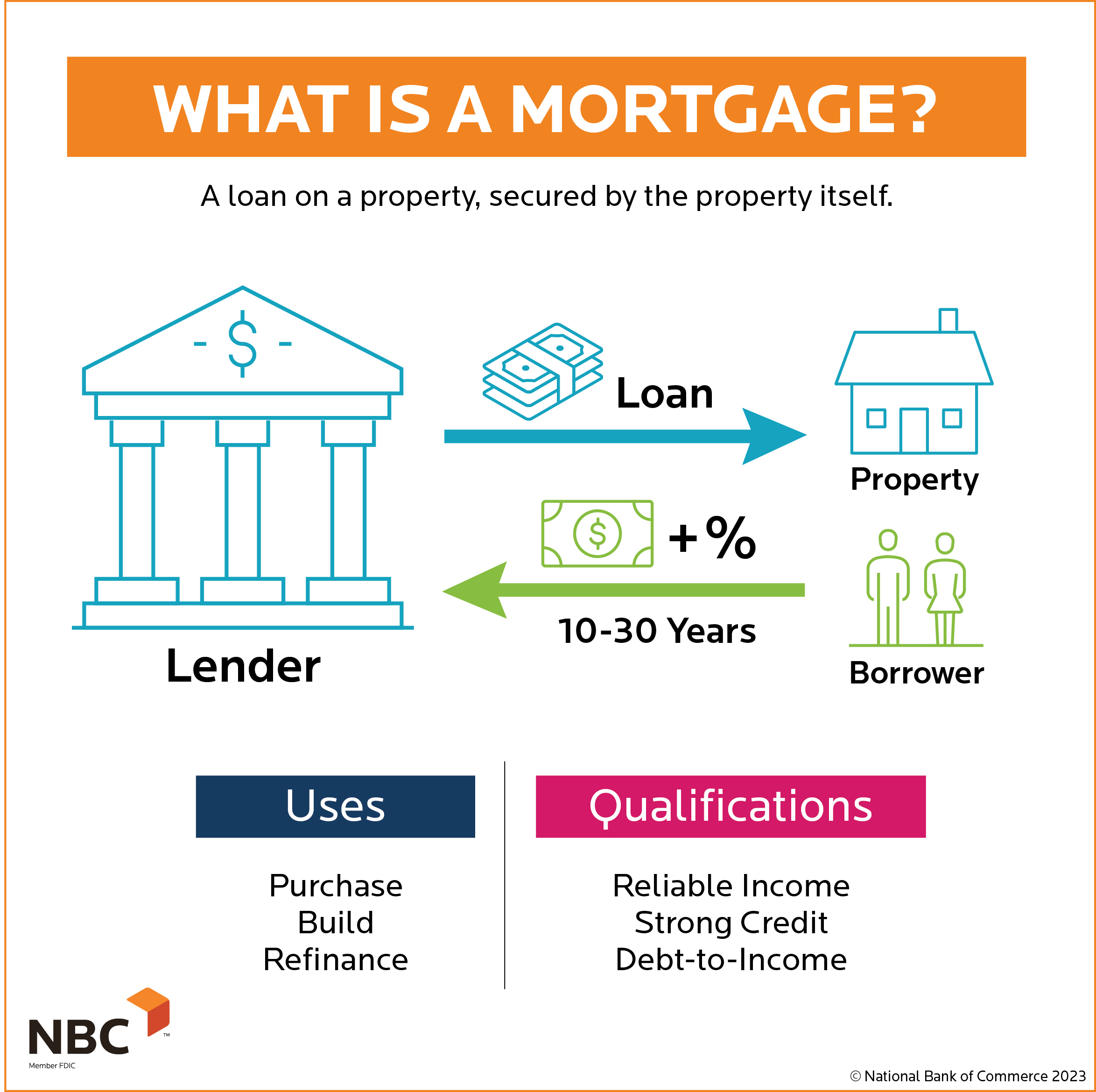

Exactly how do home mortgage brokers promote the homeownership trip for potential customers? Home mortgage brokers offer as middlemans in between potential home owners and lending institutions, simplifying the lending process and giving skilled guidance.

Furthermore, mortgage brokers educate purchasers concerning the details of home mortgage applications, consisting of needed paperwork and debt demands. They aid in celebration and arranging documents, which simplifies the taxing and often intricate procedure for clients. Additionally, brokers function as advocates during arrangements with lenders, functioning to protect positive terms and conditions in behalf of their customers.

Fundamentally, home loan brokers play a vital role in debunking the home financing procedure, using customized assistance and proficiency that empower possible purchasers to make informed choices on their journey towards homeownership. Their involvement can significantly improve the efficiency and performance of protecting a mortgage.

Benefits of Functioning With Brokers

When prospective home owners select to collaborate with home mortgage brokers, they get accessibility to an array of benefits that can dramatically enhance their home loan experience. One of the key advantages is the broker's capability to supply personalized assistance customized to individual monetary circumstances and homeownership objectives. Mortgage Broker. This individualized approach makes sure that customers get alternatives that ideal fit their unique situations

Moreover, home loan brokers have accessibility to a large selection of loan providers and home mortgage products, allowing them to look around for the most competitive rates and terms. This level of gain access to often surpasses what a common consumer can accomplish by themselves, resulting in prospective price financial savings over the life of the car loan.

Furthermore, brokers possess comprehensive knowledge of the home loan industry, including current patterns and requirements. Their knowledge can assist clients navigate complex documentation and policies, eventually resulting in a smoother application process. Additionally, brokers commonly have actually developed connections with loan providers, which can help with quicker reactions and authorizations.

How Brokers Simplify the Process

Home mortgage brokers play a critical duty in enhancing the home financing process for possible property owners. By serving as middlemans between customers and lenders, brokers promote a smoother experience for clients navigating the commonly complicated home mortgage landscape. They take advantage of their extensive networks to provide debtors access to a range of lending alternatives, making sure that clients get customized services that align with their financial conditions and goals.

Brokers streamline the procedure by performing in-depth assessments of a client's monetary situation, including credit history, income, and existing financial obligations. This first assessment permits brokers to identify appropriate home mortgage items and pre-qualify clients, conserving time and lowering unnecessary applications. They aid in celebration and arranging the required documentation, such as tax obligation returns and financial institution declarations, which can be overwhelming for novice purchasers.

Choosing the Right Mortgage Broker

Choosing the ideal home loan broker is important to guaranteeing a successful home financing experience, click to read as the ideal professional can significantly affect the result of your mortgage trip. Begin by examining the broker's credentials and experience. Look for brokers that are certified and have a strong record in your area, as neighborhood experience can be very useful.

Next, evaluate their series of solutions. A good home mortgage broker must use access to numerous finance products from numerous lenders, enabling you to compare options properly. Furthermore, ask about their charge framework-- comprehending just how they are compensated will certainly help you prevent unexpected expenses.

Communication is another important factor. Pick a broker who is receptive and ready to put in the time to discuss intricate terms and procedures. This openness fosters depend on and ensures you feel comfortable throughout the home mortgage process.

Success Stories From Homeowners

Numerous house owners have actually browsed the intricate globe of home funding with the assistance of experienced home mortgage brokers, bring about effective and meeting homeownership experiences. One such success tale entails a young pair who imagined possessing their initial home. With the advice of their home mortgage broker, they protected a beneficial funding regardless of having actually limited credit background. This broker helped them recognize their options, enabling them to acquire a captivating starter home that fulfilled their requirements.

One more motivating example is a single mom that looked for support after encountering economic problems. Her mortgage broker functioned faithfully to locate a loan program that supplied lower deposit alternatives and favorable terms. With specialist recommendations and unwavering assistance, she was able to shut on a home that gave a steady environment for her kids.

These tales exemplify the devotion of mortgage brokers in transforming desires into reality. Mortgage Lenders Omaha. By promoting and giving individualized remedies for their customers, these professionals not only assist in deals yet also empower check my blog individuals to accomplish the desire for homeownership. Such success tales highlight the vital function home loan brokers play in making homeownership obtainable and possible for diverse demographics

Conclusion

In conclusion, home loan brokers play a crucial role in helping with homeownership by supplying customized options and skilled advice. Their extensive understanding of the home loan landscape allows customers to navigate complicated processes and safe and secure favorable lending terms. By fostering informed decision-making and advocating for the very best rate of interests of clients, home loan brokers considerably contribute to changing the desire of homeownership into a substantial truth for diverse individuals and family members. Their devotion eventually enhances accessibility within the real estate market.

In addition, mortgage brokers educate customers concerning the ins and outs of home loan applications, including needed documentation and credit needs.When prospective house owners select to function with mortgage brokers, they obtain access to an array of benefits that can dramatically improve their home mortgage experience. By acting as intermediaries in between loan providers and debtors, brokers assist in a smoother experience for customers navigating the frequently complex home loan landscape.Choosing the appropriate mortgage broker is important to making sure a successful home funding experience, as the right expert can significantly influence the outcome of your mortgage journey. By fostering educated decision-making and advocating for the ideal interests of clients, mortgage brokers dramatically add to changing the goal of homeownership right into a tangible reality for diverse people and households.

Comments on “Leading Mortgage Lenders in Omaha Offering Competitive Fees and Flexible Terms”